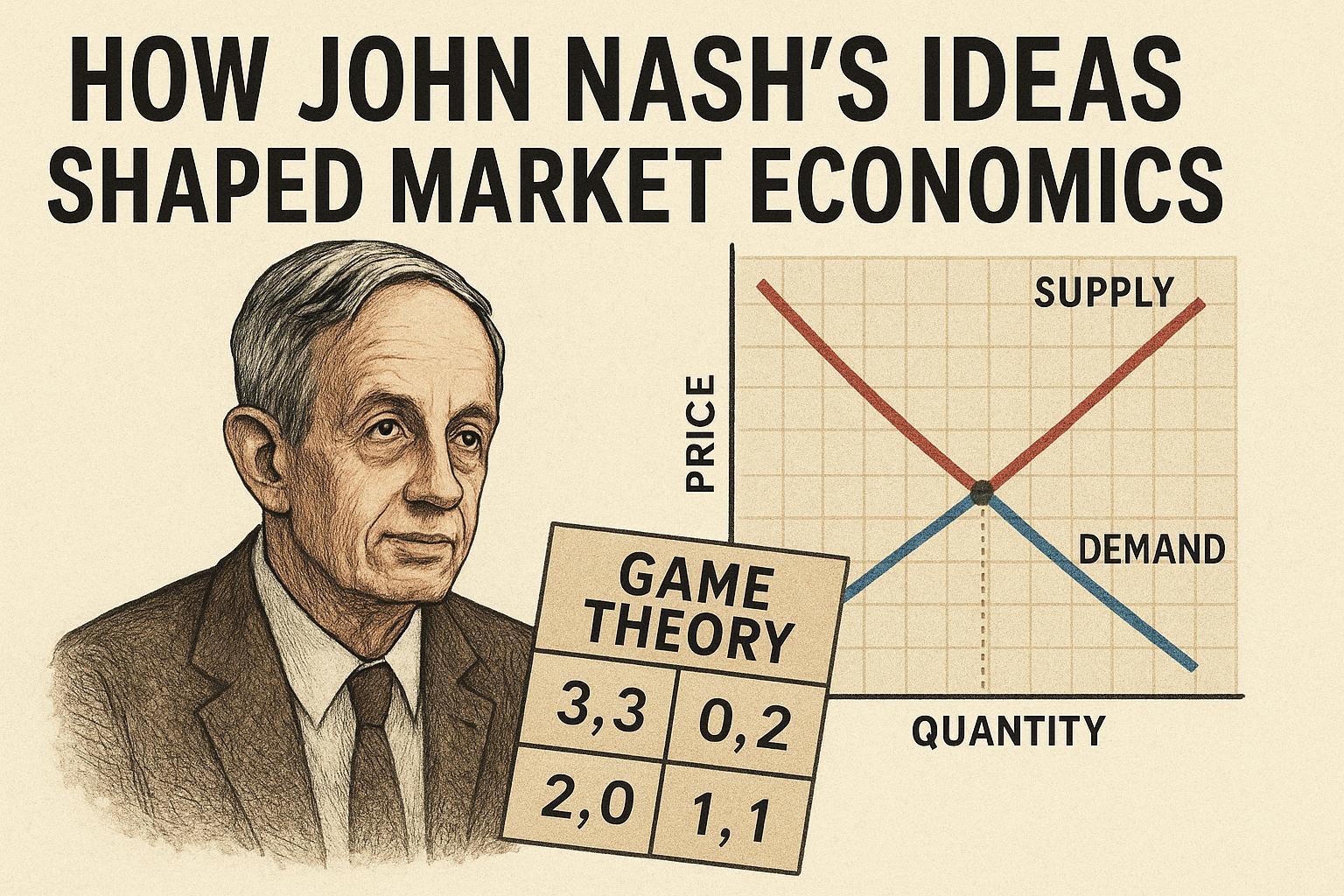

Introduction to John Nash and His Impact on Market Economics

John Nash, an esteemed American mathematician, has left an indelible mark across several academic fields, notably economics, mathematics, and decision theory. His visionary work in game theory was recognized with the Nobel Prize in Economic Sciences in 1994. While Nash’s influence extends through a myriad of disciplines, his theories have had a particularly significant impact on market economics, profoundly reshaping the way economists perceive competitive strategies and market equilibrium.

Nash Equilibrium: A Fundamental Concept

One of the most significant theoretical contributions by John Nash is the concept of the Nash Equilibrium. In the realm of game theory, a Nash Equilibrium occurs when participants in a game, each employing a specific strategy, find no advantage in changing their strategy unilaterally. To put it simply, it is a condition of balance where each player’s choice is optimal in response to the decisions of other players. This concept has cemented itself as a foundational element in competitive economic models, offering a systematic approach to understanding strategic interactions within various markets.

Application in Oligopolistic Markets

The application of the Nash Equilibrium is especially pertinent in oligopolistic markets, characterized by a limited number of dominant firms. In these markets, decisions concerning production levels, pricing strategies, and other strategic variables are heavily dependent on how each firm anticipates the reactions of its competitors. Nash’s theoretical framework assists economists in predicting these outcomes and comprehending the stability of diverse market equilibria. This insight is crucial for analyzing how firms negotiate agreements, determine price levels, and respond to regulatory policies, enhancing our overall understanding of market dynamics.

Understanding Competitive Strategy

The Nash Equilibrium not only explains how firms operate in oligopolistic scenarios but also sheds light on competitive strategies. Companies frequently employ game theory concepts when developing strategies that account for competitors’ potential decisions. By predicting opponents’ actions, firms can optimize their strategies to maximize profits or market share. This predictive capability is intrinsically tied to Nash’s work, which provides a structure for studying complex interactions in competitive environments.

Influence on Auction Theory

John Nash’s insights have also had a profound effect on the field of auction theory. His exploration of strategic behavior has been pivotal in the creation of more efficient auction formats, especially in contexts where bidders possess private information about their valuations of items. Such auction designs ensure that competition is both fair and efficient, leading to an optimal allocation of resources. This efficiency is beneficial to both buyers and sellers, as it facilitates fair competition and maximizes the potential gains from trade.

Impact on Financial Markets

Within financial markets, Nash’s contributions are deeply felt in the domain of mechanism design. This subfield of economics focuses on devising optimal structures for economic transactions. By comprehending the strategic interactions between agents, economists can formulate mechanisms that lead to desirable market outcomes, even when faced with asymmetric information. The foundational work that Nash laid in this area has been instrumental in the creation of innovative models pertaining to trading strategies, pricing mechanisms, and risk management frameworks.

Implications for Market Efficiency

Nash’s theories also offer insights into market efficiency. By analyzing how agents interact strategically, economists can design systems that improve market outcomes, promoting efficiency and stability. These mechanisms are especially relevant in financial markets, where strategic interactions are intricate and multifaceted. Nash’s ideas enable economists and policymakers to enhance market efficiency, thereby creating more resilient economic systems.

Considerations for Regulatory Frameworks

The implications of Nash’s work extend to the development of regulatory policies. By understanding the strategic behavior of firms and individuals within a market, regulators can devise policies that better align with the desired economic outcomes. These insights can lead to improved regulatory frameworks that balance competition and collaboration, ultimately fostering a more robust and equitable economic environment.

Conclusion: The Legacy of Nash in Economics

The intellectual legacy of John Nash in market economics is both profound and pervasive. His groundbreaking work in game theory and the Nash Equilibrium has endowed economists with robust tools for dissecting strategic interactions. These contributions have paved the way for more sophisticated and realistic economic models that better mimic the intricacies of real-world market behavior. As a result, Nash’s insights continue to influence how economists and policymakers approach a myriad of issues, from competition to regulation.

In summary, John Nash’s pioneering ideas in game theory have fundamentally transformed our comprehension of economic behavior and decision-making in competitive contexts. Through his innovative concepts, Nash has equipped the field of economics with the analytical foundations necessary to tackle complex market dynamics, ensuring his enduring influence on modern economic thought and practice.

This article was last updated on: October 26, 2025